simplest solutions to your credit Problems.

Securing and leveraging good credit is an extremely important part of your mission to create the lifestyle you want and deserve. We are committed to partnering with you on your journey to a debt free life.

“LET YOUR TOMORROW BEGIN!”

How Credit Repair Works

Our staff is extensively knowledgeable on recent laws, statutes, and credit reporting practices. We will conduct an in-depth analysis of your current credit status.

Have you experienced roadblocks in acquiring a home or auto loan? We can help! Relleyvent Solutions will reach out to your creditors and advocate on your behalf by challenging various inaccuracies from all 3 credit reporting bureaus. Every client has as a unique set of circumstances which has led them to their current financial struggles. Relleyvent Solutions takes great pride in our extensive knowledge of the Fair Credit Reporting Act which has empowered us to be able to develop a unique strategy and a customized plan of action that will put you on the right path to achieving financial success.

What Can You Expect From Us?

- FREE CREDIT CONSULTATION

- RESULTS TYPICALLY IN 30-45 DAYS

- NO HIDDEN FEES

- UNLIMITED DISPUTES

- DEBT MANAGEMENT PLAN

- UNLIMITED SUPPORT

Our Services

Credit Consultation & Audit

We will perform a thorough credit analysis to identify any discrepancies on your report. A credit analyst will provide you with a consultation to discuss the credit scores on all three credit bureaus. Your analyst will then explain our program, how it works and cover what options are available to get your credit back on track.

Credit Restoration

Our amazing team of credit experts will fight on your behalf to dispute inaccuracies using credit laws (FCRA) and you will receive periodic updates of our progress.

Credit Counseling

In addition to credit repair services, we will also provide coaching on how you can rebuild your credit. The credit rebuilding process is a critical step, and we will be with you every step of the way providing you with expert advice on what you can do to reach your financial goals.

Credit Education

While we go to work on your credit disputes, we will show you how to follow our useful credit education tips and how teach you the best strategies on how you can rebuild positive credit as your score increases.

There are three credit reporting bureaus, Equifax, Experian and TransUnion. Our job will be to perform a thorough credit analysis to pinpoint and dispute inaccurate and unverifiable entries on your credit reports.

Our Pricing

Launch Promo

Package

$129 Enrollment/Audit Fee

For A Limited Time

-

Unlimited Disputes

-

3-Credit Bureau Audit

-

24/7 Client Portal Access

-

Monthly Updates

-

Credit Education

-

No Contract

-

Money Back Guarantee (if no results in 120 days)

Enrollment Basic Package

$129 Enrollment/Audit Fee-

Unlimited Disputes

-

3-Credit Bureau Audit

-

24/7 Client Portal Access

-

Monthly Updates

-

Credit Education

-

No Contract

-

Money Back Guarantee (if no results in 120 days)

Couple’s Package

$199 Enrollment/Audit Fee-

Unlimited Disputes

-

3-Credit Bureau Audit

-

24/7 Client Portal Access

-

Monthly Updates

-

Credit Education

-

No Contract

-

Money Back Guarantee (if no results in 120 days)

What Is a Credit Score?

How Credit Scores Work?

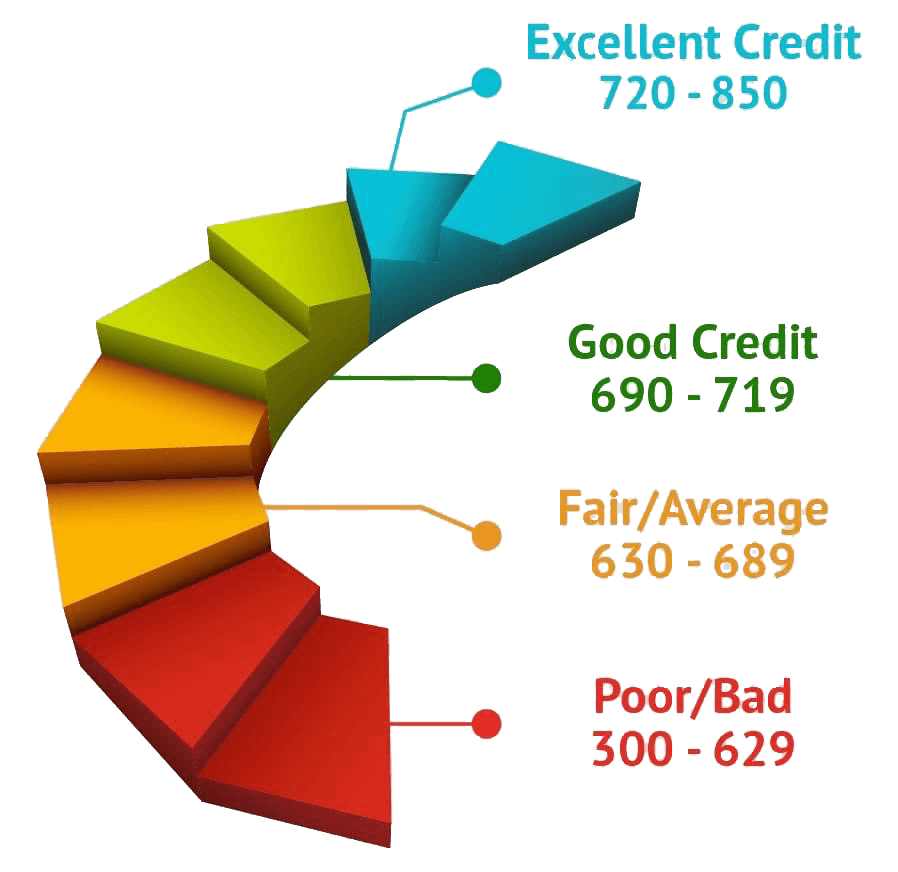

Consumers with a credit score below 640 for example, are typically considered to be subprime borrowers. Lenders will often charge a higher interest rate on subprime mortgages than they would on a conventional mortgage due to the risk involved.

A credit score of 700 or above is generally considered good and in a lot of cases, a borrower can receive a lower interest rate which will permit a borrower to pay less money in interest over the life of the loan. Credit scores greater than 800 are considered excellent. While every creditor defines their own scope for creditworthiness, the average FICO score range is often used.

720-850 EXCELLENT

700-719 VERY GOOD

675-699 GOOD

620-674 AVERAGE

560-619 POOR

500-559 VERY POOR

FAQs

You are entitled to a 100% refund on all monthly payments if:

- We do not remove any negative items worked on.

- If it has been 120 days (4 consecutive months) from the time that you retain our services.

- You have not used a credit-consulting agency or attempted to repair your own credit at least 1 year prior to signing up for our services.

- You have no new collections or missed payments within the timeframe we are assisting you.

- You must maintain credit monitoring services during the entire timeframe we are assisting you.

- You agree and have sent updated reports/responses from the three credit bureaus and creditors to us within 5 days of receipt. You should receive updated credit reports every 35-45 days and make us aware if updated reports have not been received.

Yes, credit repair is legal and our credit education and document processing services will help you to use the law in your favor. That law is called "The Fair Credit Reporting Act." The FCRA gives you the right to dispute any item on your credit report. If the item cannot be verified within a reasonable timeframe (usually 30 days) it must be removed. Studies have shown that 80% of all credit reports contain errors, which is nearly 8 out of 10 reports. Therefore, most credit reports will show immediate improvement. On items that are disputed and are

not errors, creditors are often unable to find the records or signed documents within the allotted time and in most cases the item will get removed. A creditor may verify a reported item without proving the debt is valid. We know the laws and are well equipped to challenge their claims on your behalf.

Useful tips on how you can raise your credit score

Pay your bills on time. Your payment history is an indication on how reliable you are for lenders considering you for a loan. This includes your utility bills, mortgage, automobile payments, and any of your open revolving lines of credit.

Keep balances low on credit cards and other revolving lines of credit. People with the best credit scores always have a low credit utilization ratio and lenders prefer credit ratios of 30% or less. You will also want to ensure your line of credit is not maxed out.

Do not close unused credit cards. Keeping them open is an excellent strategy. Closing an account can increase the credit utilization ratio and your credit score is decreased when you have few open accounts. Every few months try to make a small purchase, then pay it off to show activity.

Please refrain from charging more than 20% of the available balance on your credit cards. Banks like to see a consistent history of on-time payments, and it is favorable to have several credit lines that are not maxed-out. If you are carrying high balances on your credit cards, you will want to pay them down below 20%.

By following the above steps consistently over a significant amount of time, it will increase your credit score and make it a whole lot easier for you to qualify for better loans with lower interest rates. Repairing your credit score does not happen overnight…be patient! By applying these best practices, you will adapt better spending habits that will help you to keep your finances under control.

About Me

My name is Shirelle Reed and I have worked in Corporate America for over 2 decades in the Customer Service industry. As a Service Leader, I have always had the desire to help others and learned the business of credit repair. I have assisted countless friends, family, and business associates to achieve their career and financial goals and in most cases I provided my services free of charge.

I received sheer joy in being able to help others to overcome the difficult challenge of restoring or establishing good credit. All of this while working a full-time job in an industry where I felt unfulfilled and where I was just downright unhappy. I had always dreamed of obtaining a real estate license and I am proud to say I have recently accomplished that goal. Unfortunately, I had to put my career on pause momentarily to take care of my aging sick parents.

Fast forward to today, I have moved full speed ahead into the world of real estate and have incorporated my passion for helping people to repair their business and personal credit.

Relleyvent Solutions is licensed and bonded in the State of Texas, and this company was established so that I can fulfill my mission to help as many people as I can who are at the mercy of creditors. My passion is to help those who find themselves either being denied or having to pay outrageous interest and other fees to obtain credit assistance due to low credit scores. I have spent many years and invested a lot of money on credit education and to master the understanding of Federal and State Laws and Statutes, including the Fair Credit Reporting Act and The Fair Debt Collection Practices Act and how to advocate for your rights as a consumer.

Knowledge is POWER. Please understand that you do not have to succumb to the pitfalls of inaccurate, bad credit. Relleyvent Solutions is committed to help you improve your credit rating, and we will start the process by challenging the accuracy of your credit report. We are also strongly committed to educate you on how you can do your part to maintain your restored credit. For more information, book a consultation with us today to find out if you qualify for credit restoration services with Relleyvent Solutions.

Contact Us

Phone

(214) 474-3090

info@relleyventsolutions.com

Address

15455 Dallas Parkway, Suite 600

Addison, TX 75001